Clutch Swing Dashboard

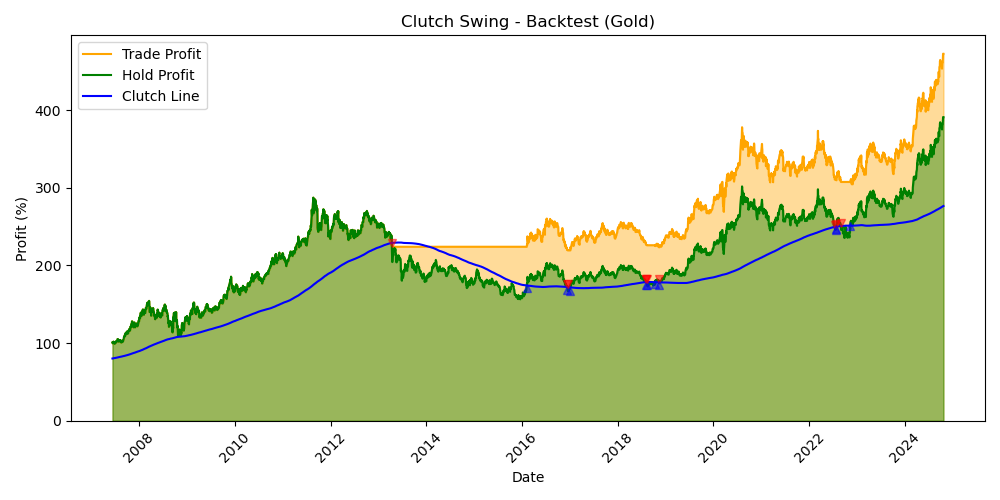

Clutch Swing is an investment strategy that minimizes losses by disengaging

from the volatility of the investment target when returns start to decline.

1) Select the investment asset from the left menu

2) Check the investment returns of the Clutch Swing strategy in the backtest chart.

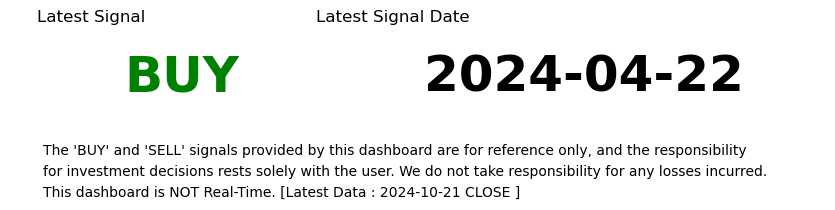

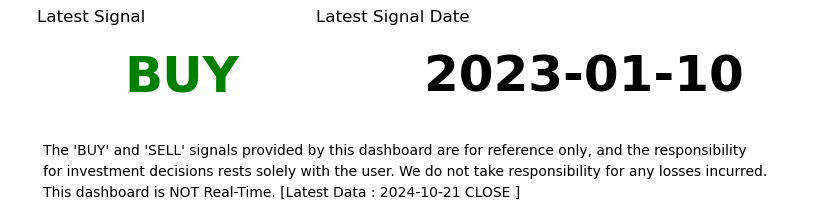

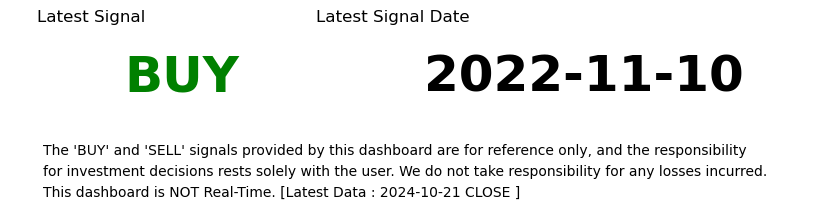

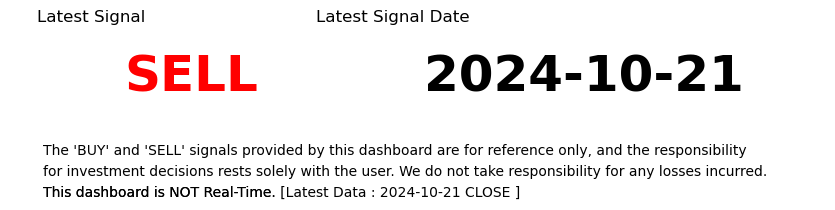

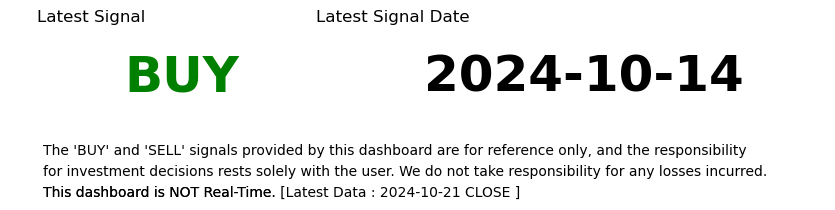

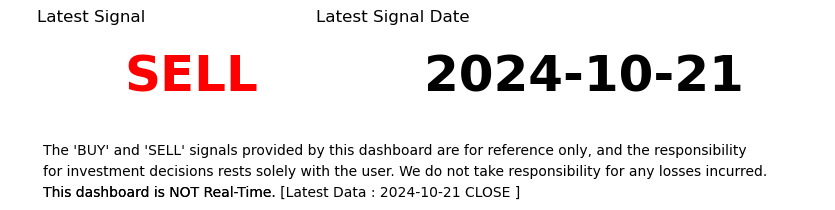

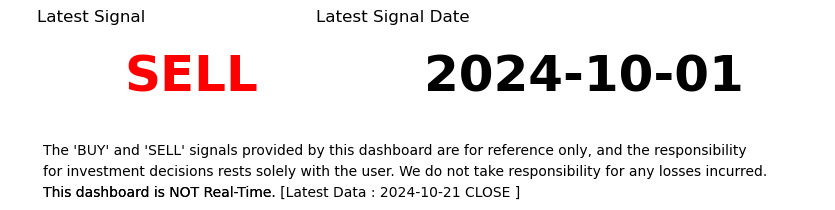

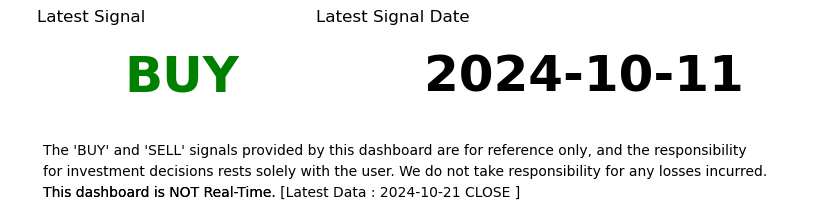

3) Check the Clutch Swing strategy's insights under 'Latest Signal' and 'Latest Signal Date'.

4) For explanations of each chart, refer to the Documents menu.

5) The Clutch Swing strategy is based on daily charts, so the update duration is once every 24 hours.

Copyright © 2024 Clutch Swing. All rights reserved.

Reproduction without permission is prohibited.

Documents

This section contains various important documents and files.

NOTICE

• This dashboard is NOT real-time.

• Update Duration : Once Every 24 Hours.

• We do not take responsibility for any losses incurred.

• Investment decisions rest solely with the user.

• The 'Buy' and 'Sell' Signals provided by this dashboard are for reference only, and the responsibility

• Always check the date of the latest data.

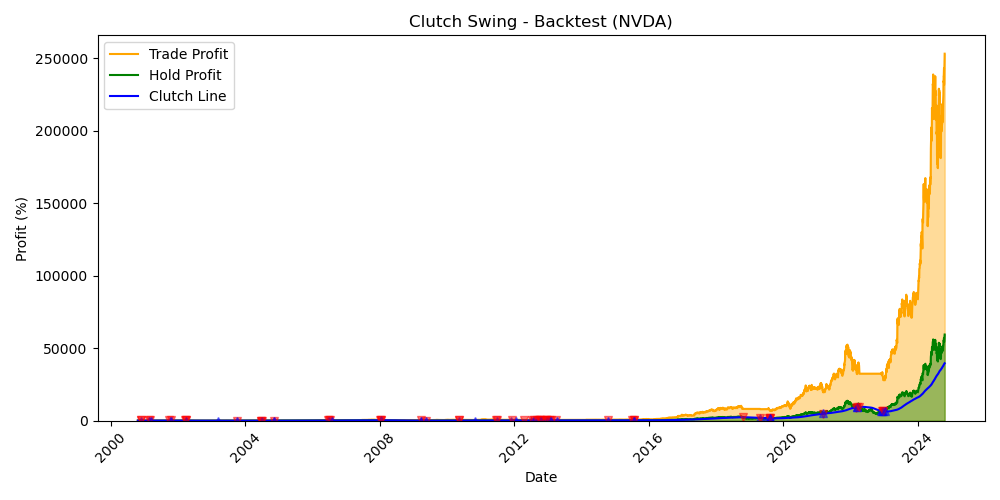

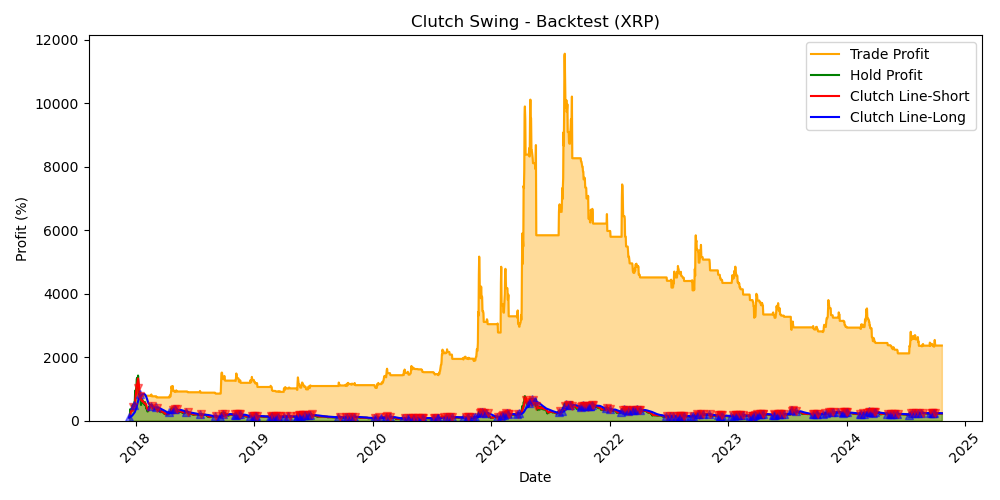

Clutch Swing Trading Strategy

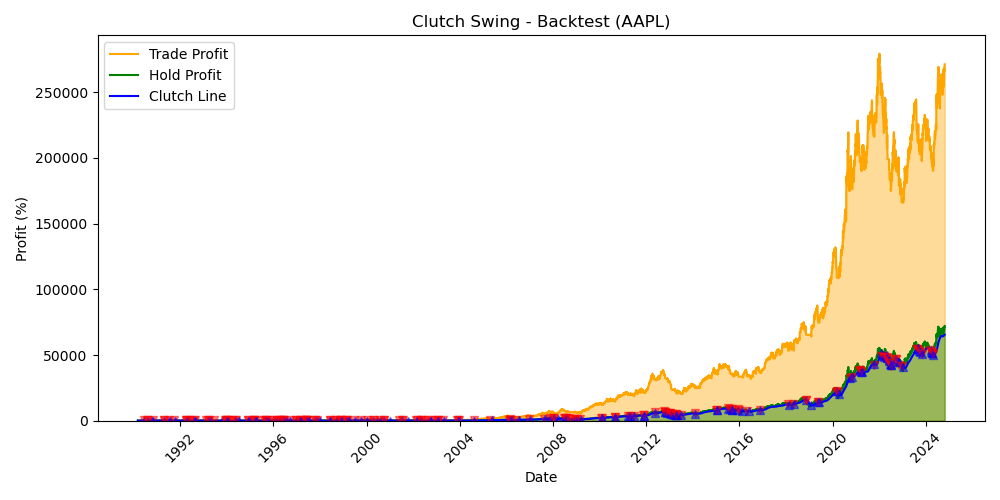

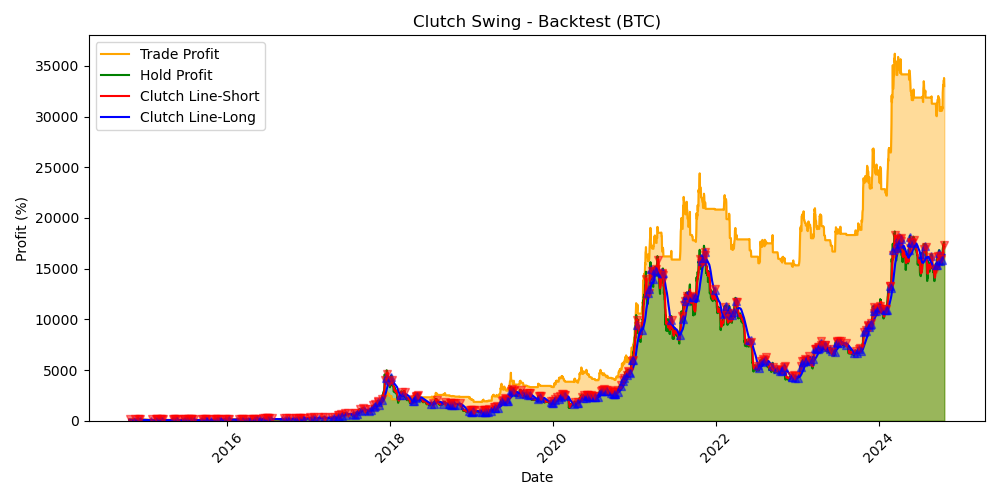

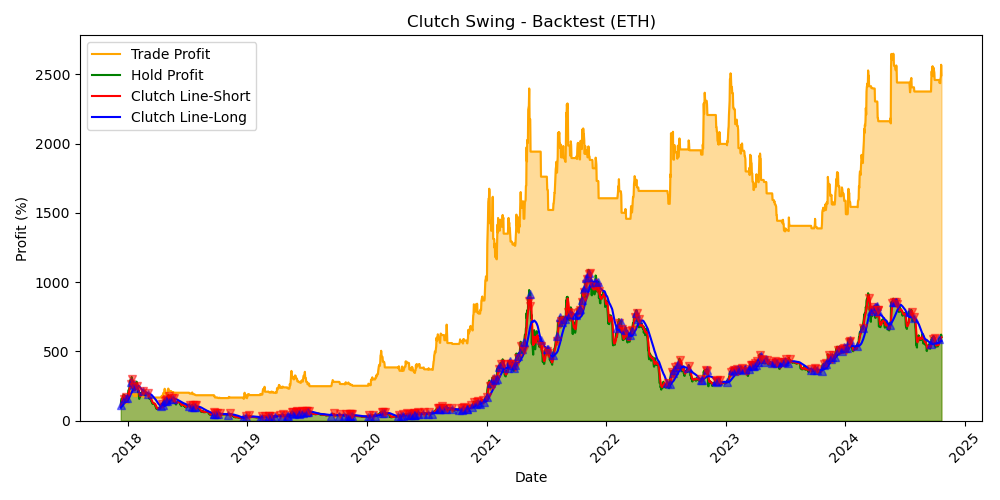

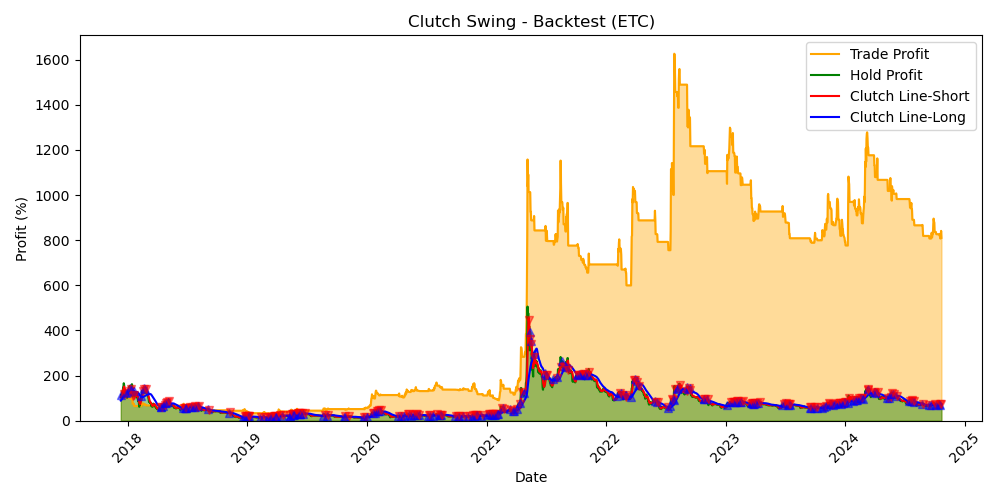

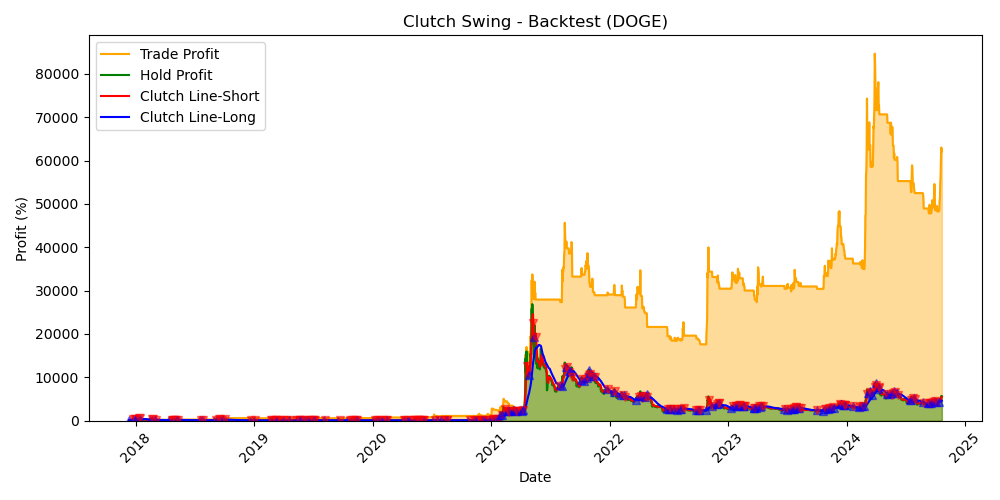

The Clutch Swing trading strategy leverages the cyclical or patterned movements of asset prices to capture optimal buy and sell points. The goal is to maximize profits and minimize losses by exploiting these price fluctuations.

Buy Signal :

A buy signal occurs when the asset's price rises above the Clutch Line. This indicates that the asset is in an oversold state, suggesting a high probability of price increase, prompting a buy action.

Sell Signal :

A sell signal occurs when the asset's price drops below the Clutch Line. This indicates that the asset is in an overbought state, suggesting a high probability of price decrease, prompting a sell action.

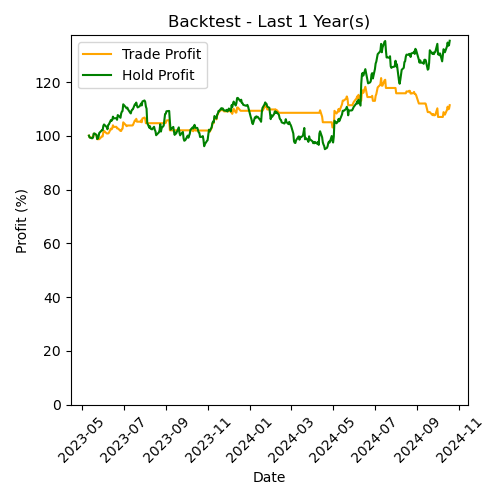

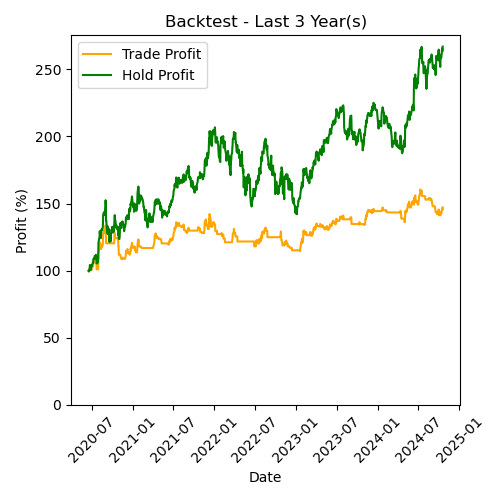

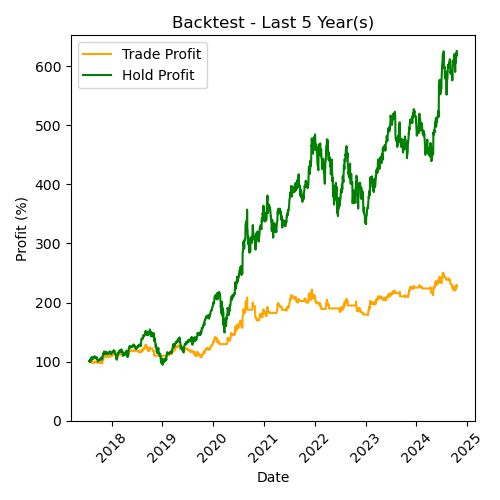

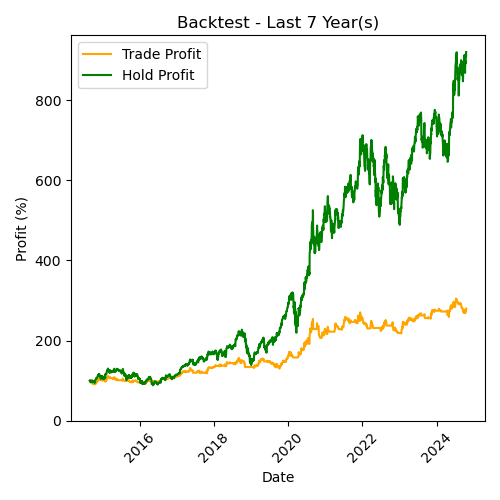

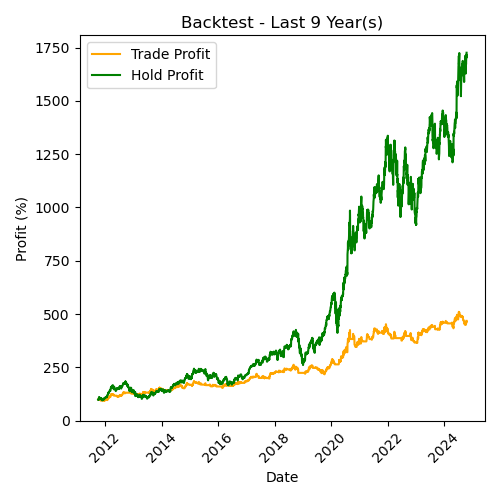

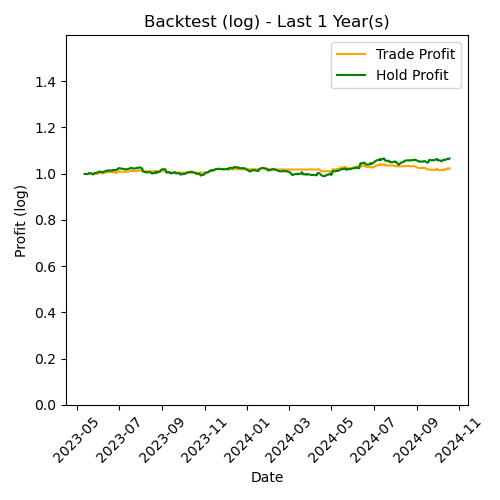

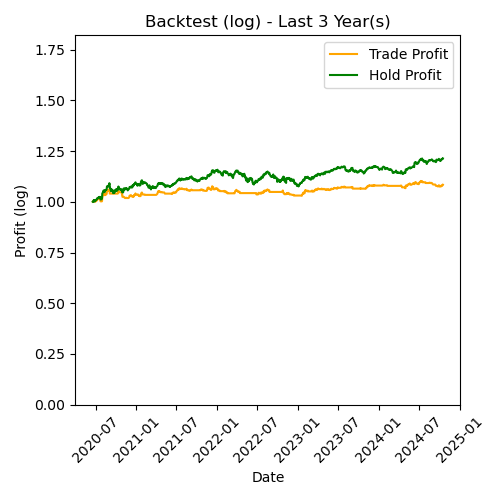

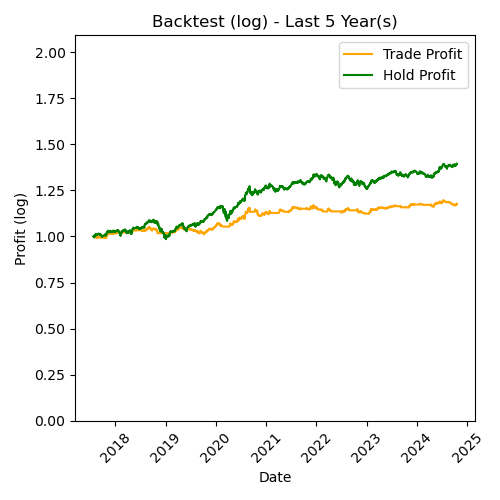

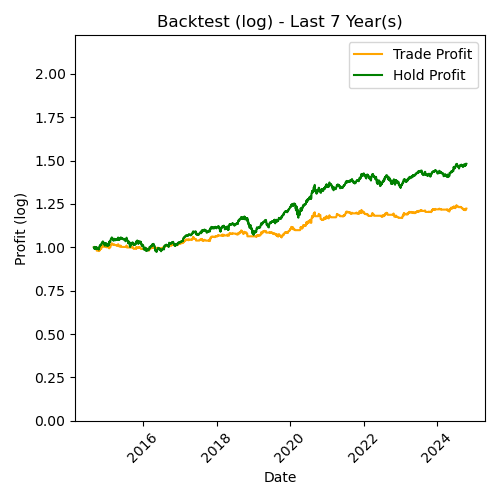

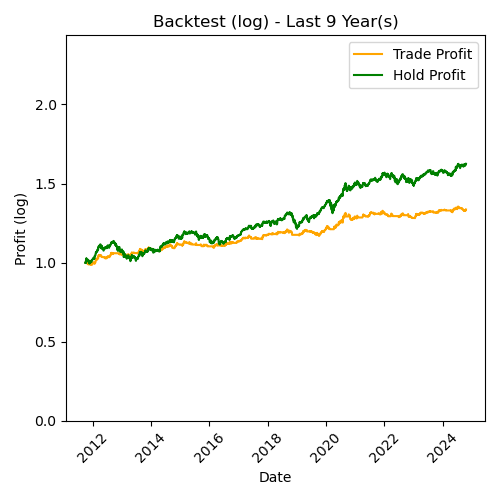

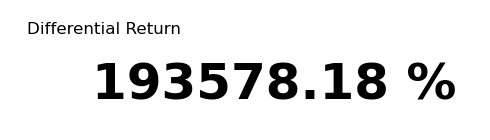

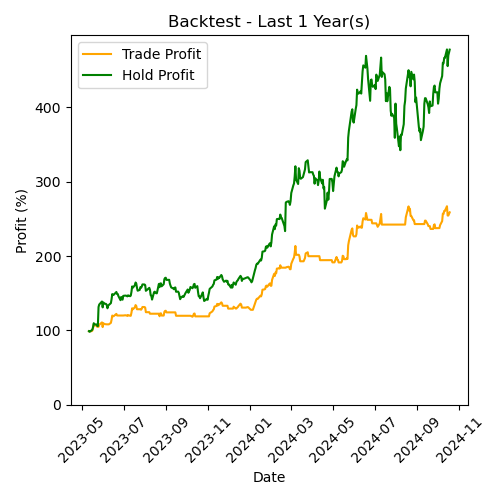

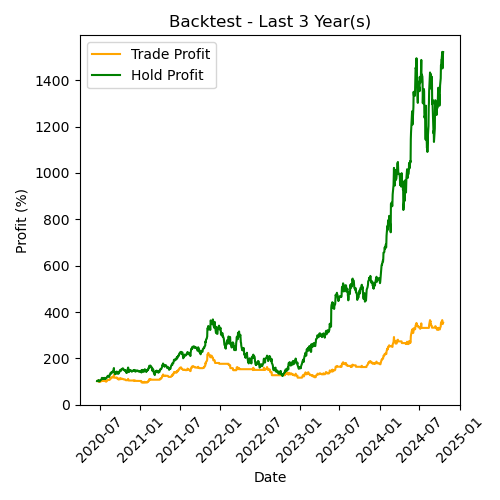

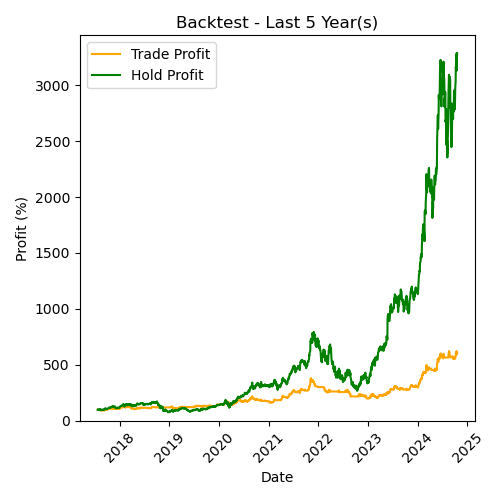

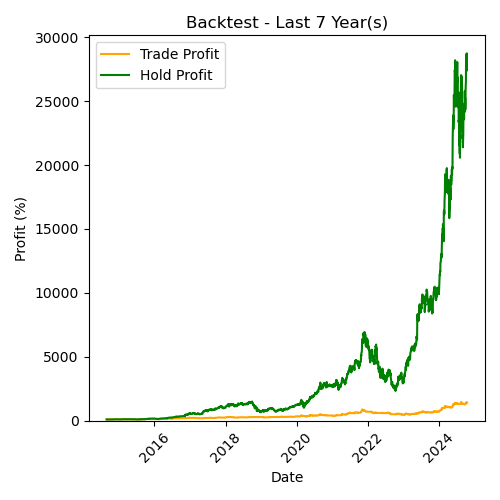

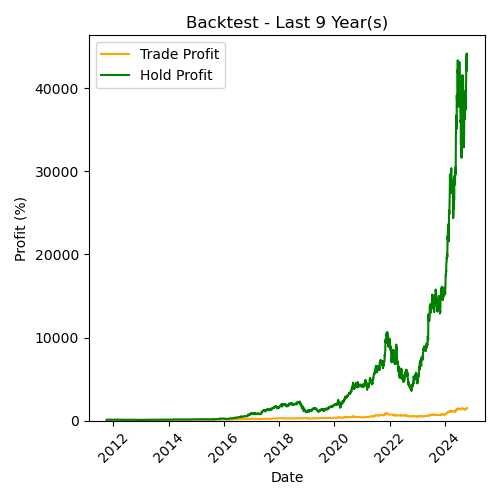

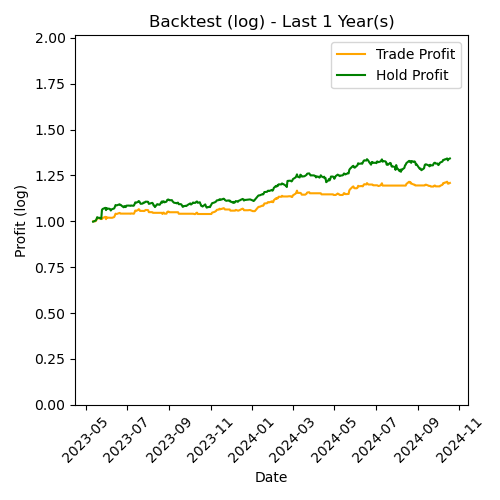

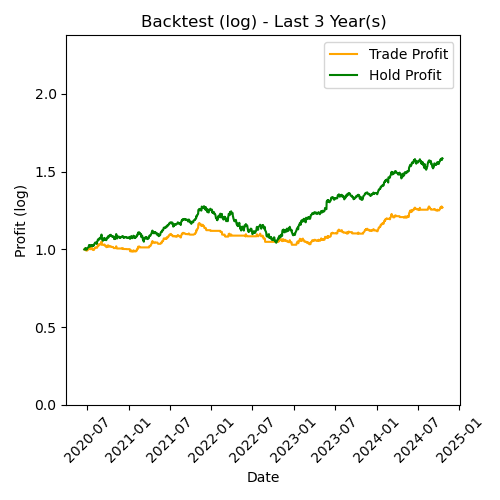

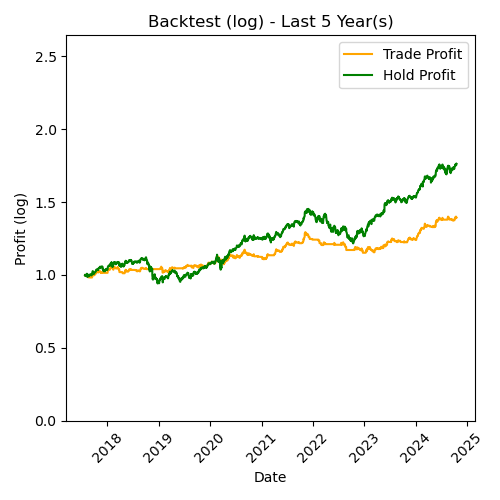

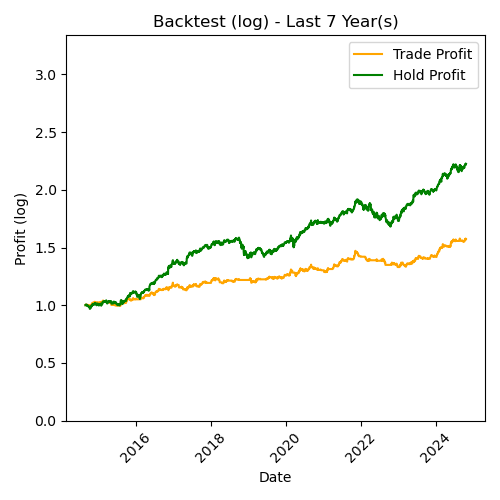

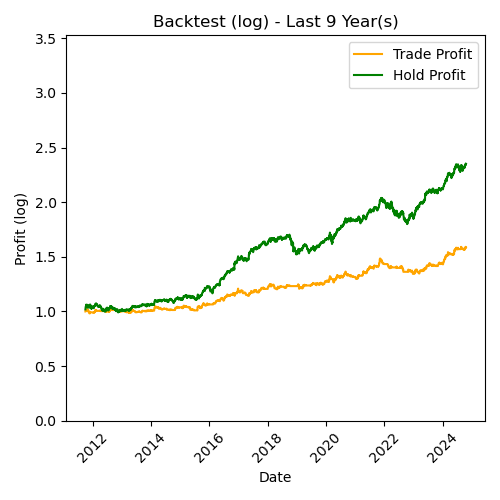

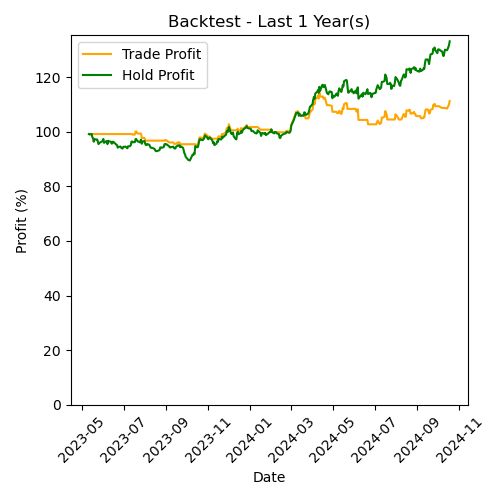

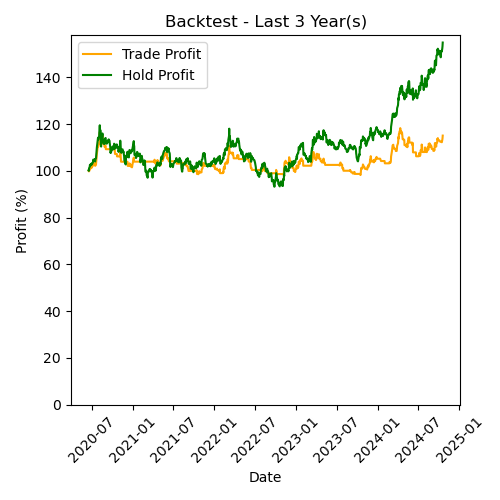

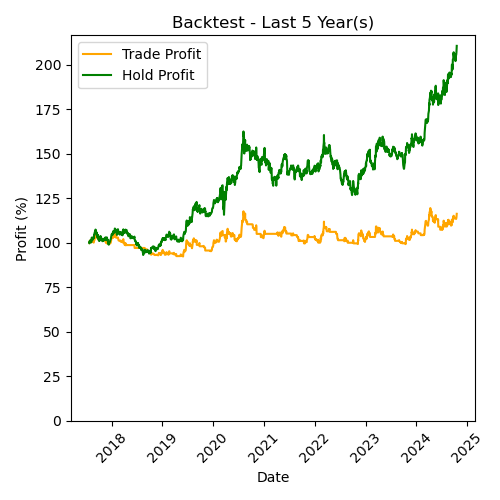

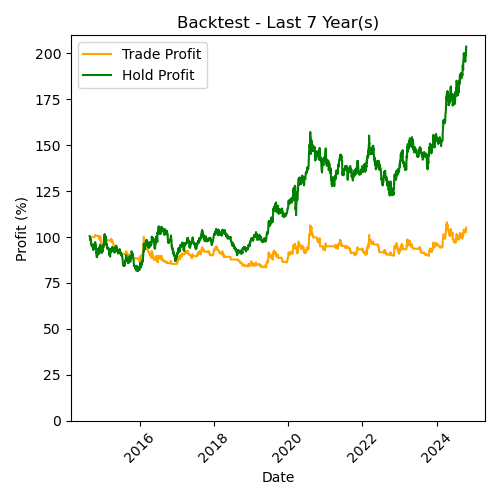

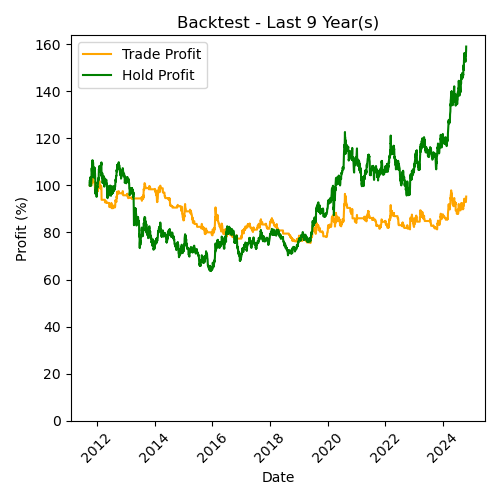

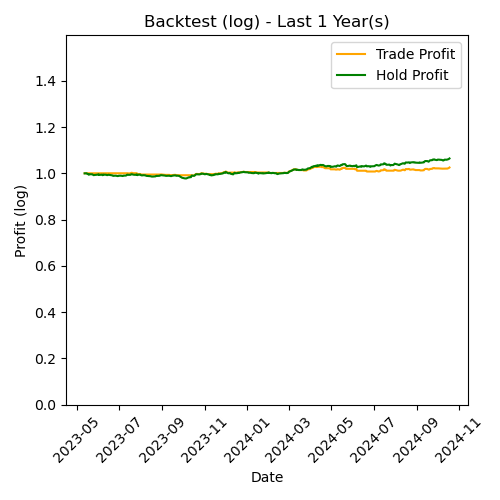

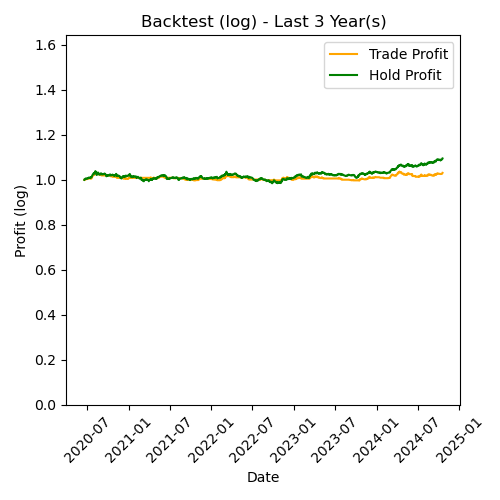

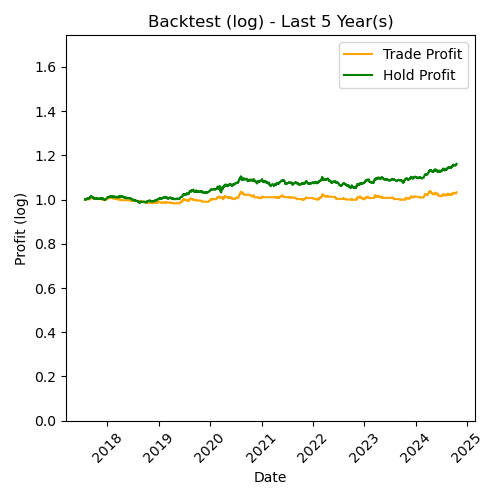

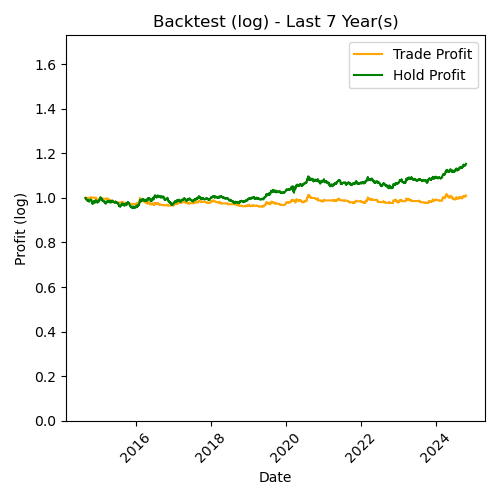

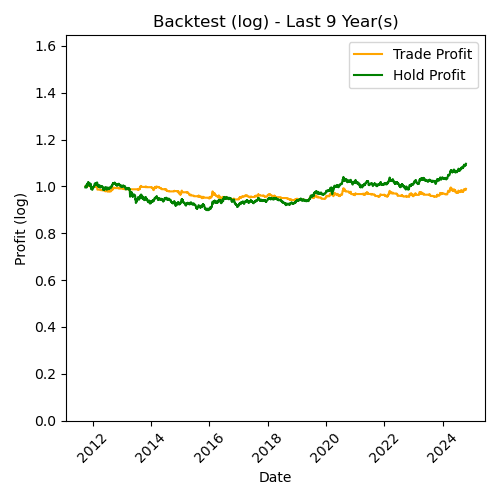

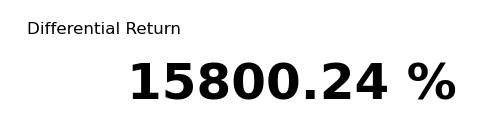

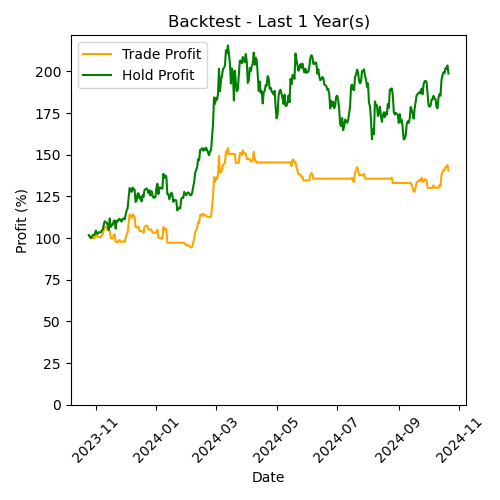

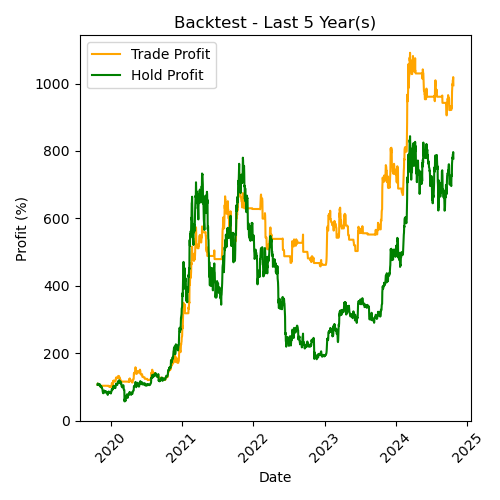

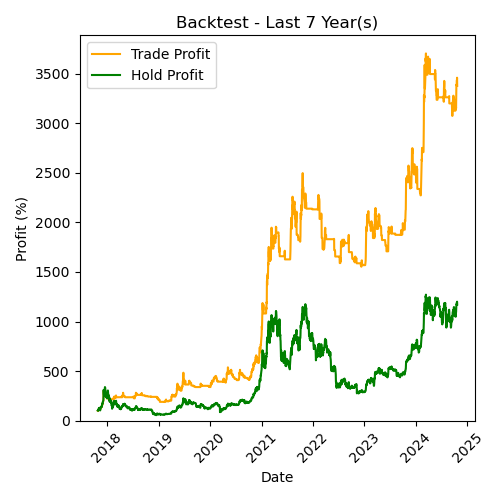

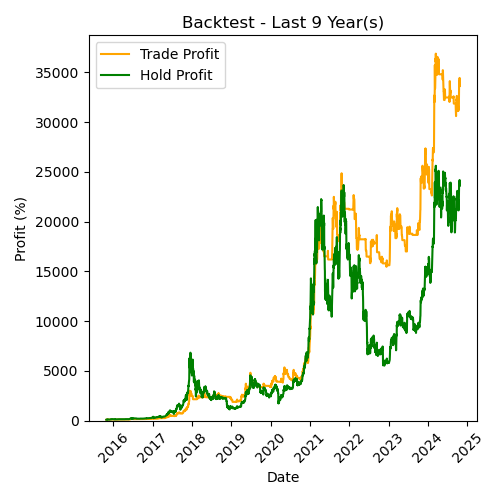

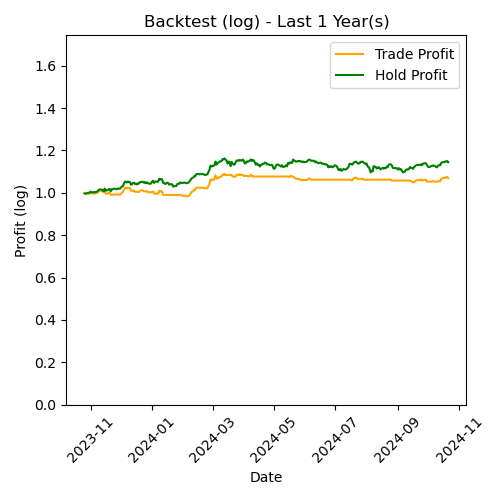

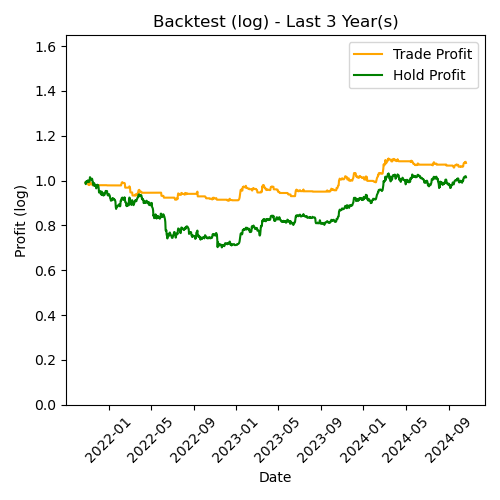

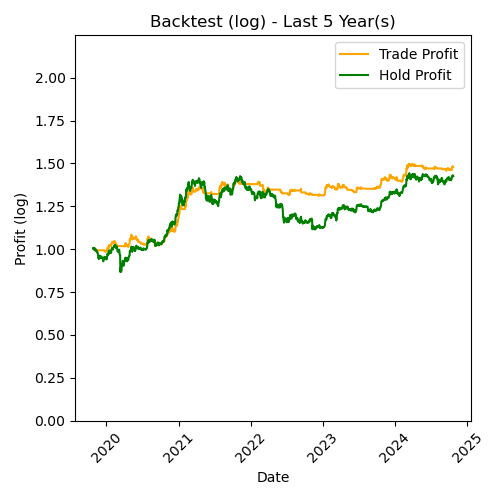

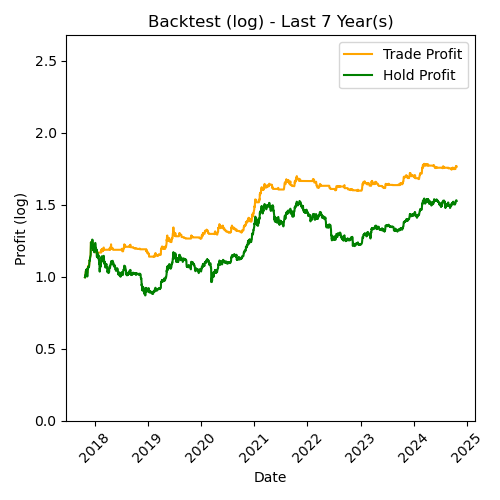

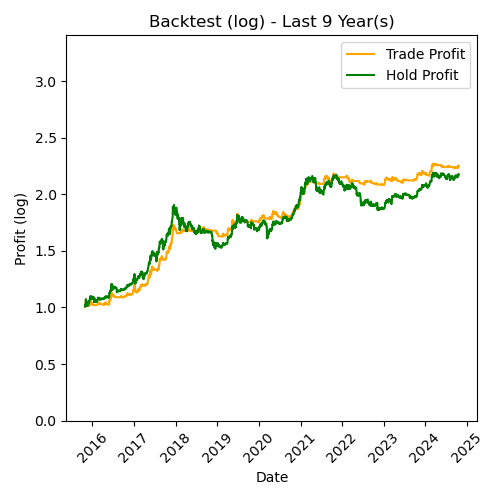

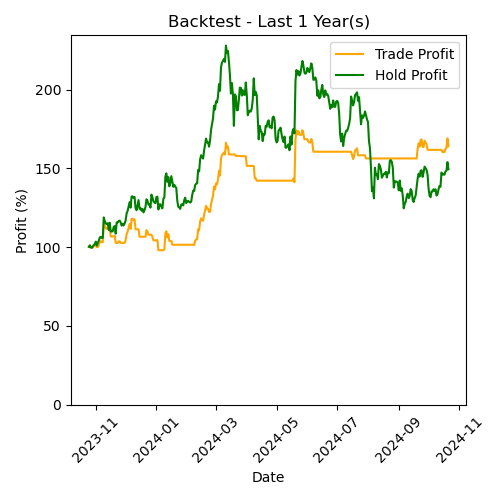

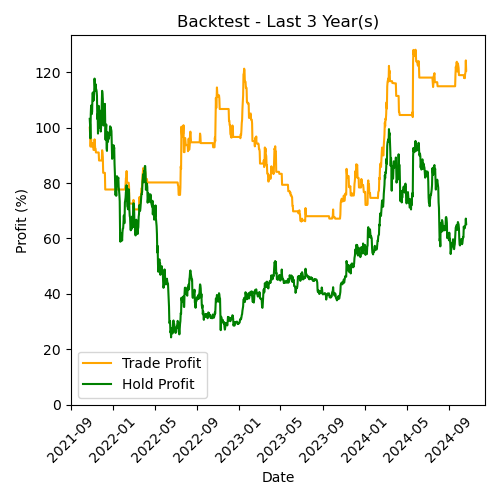

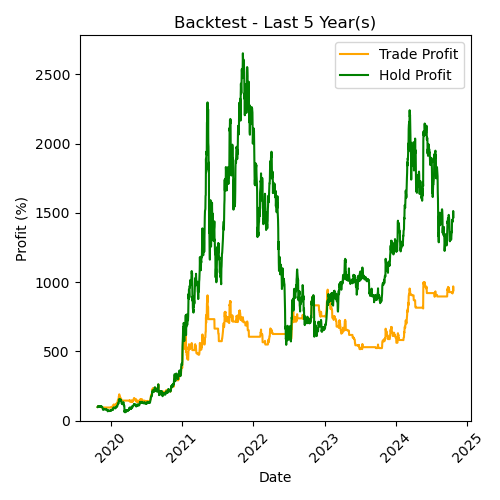

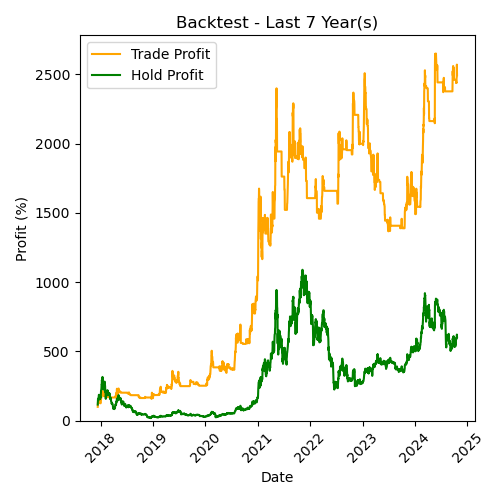

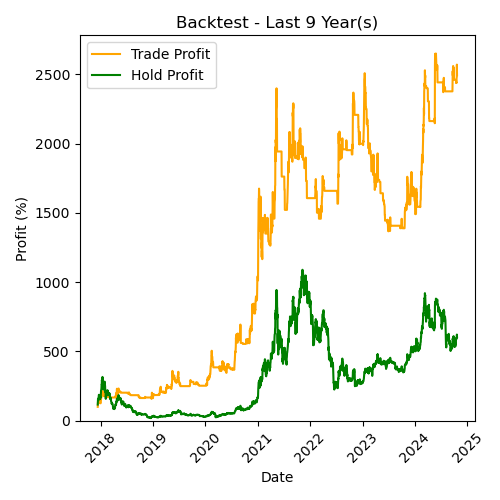

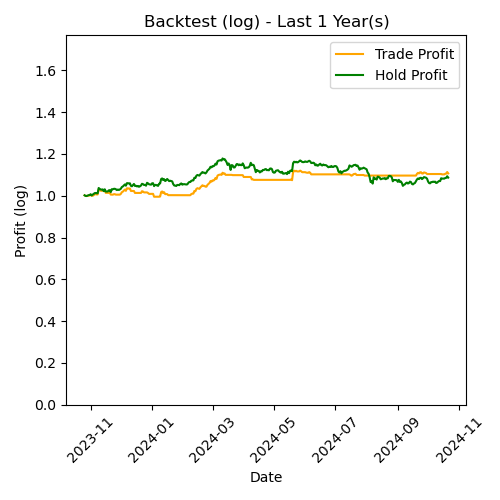

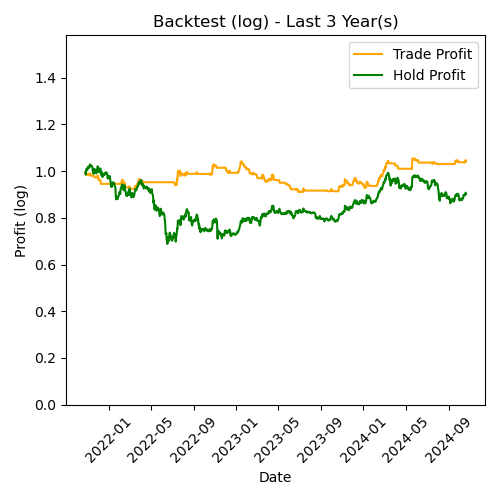

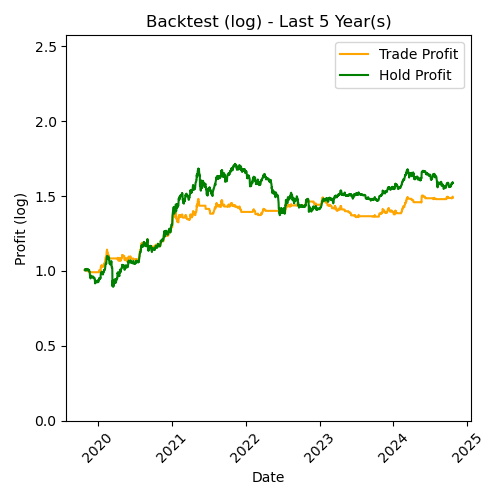

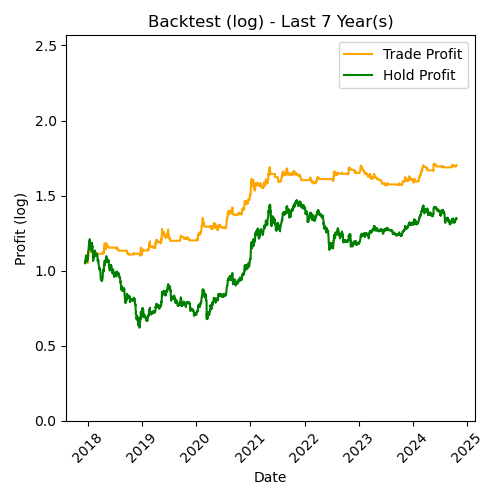

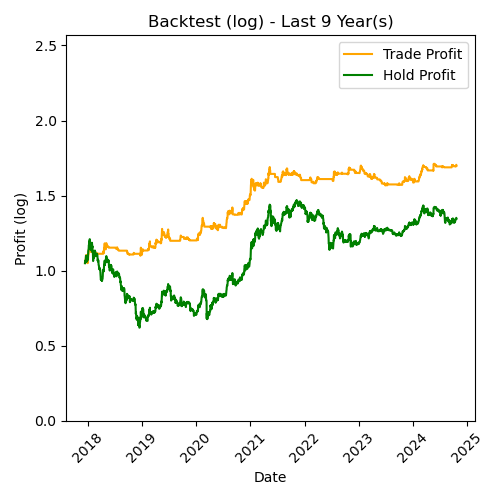

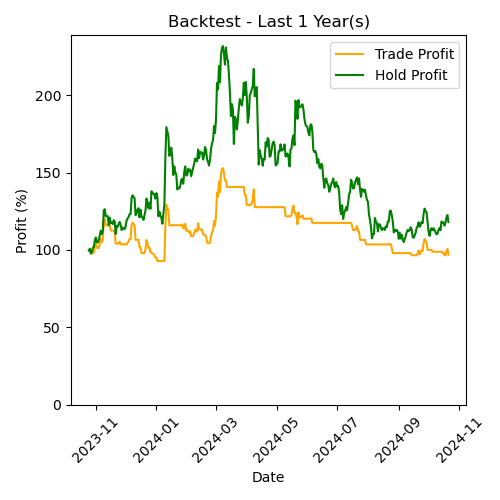

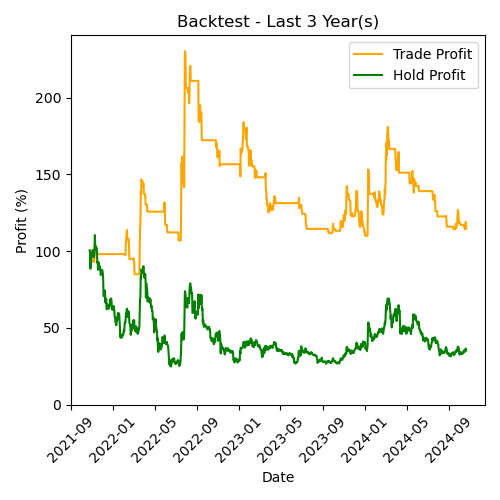

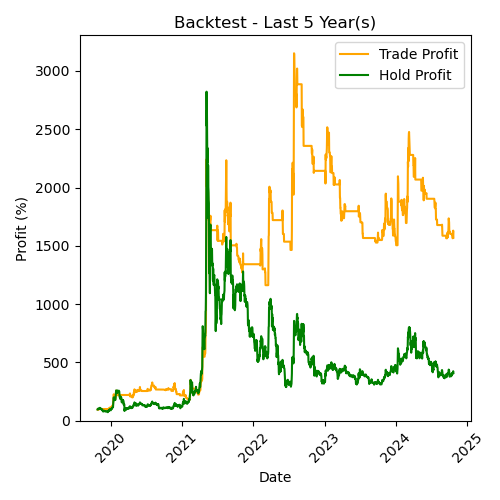

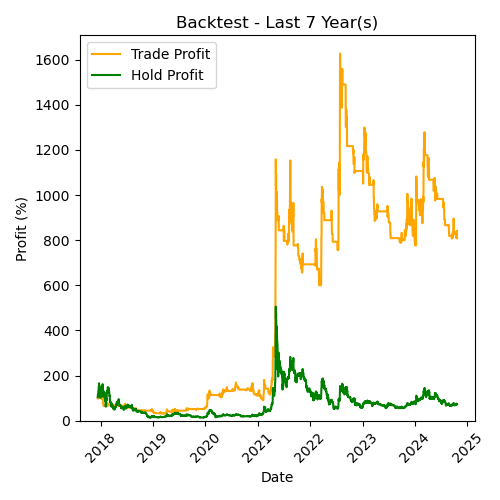

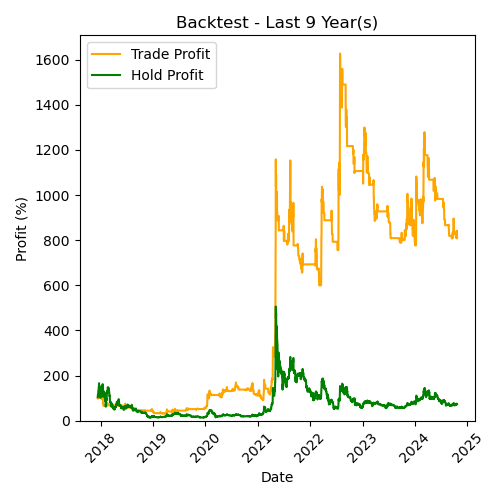

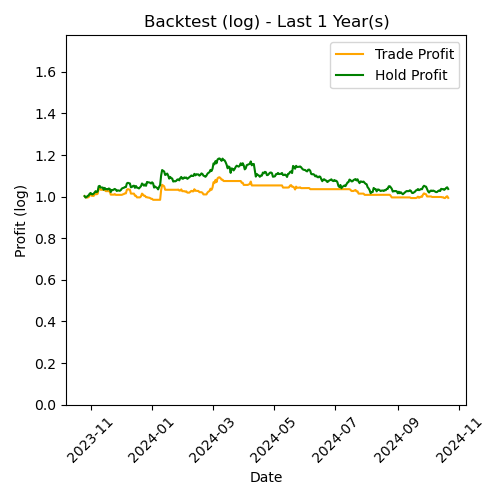

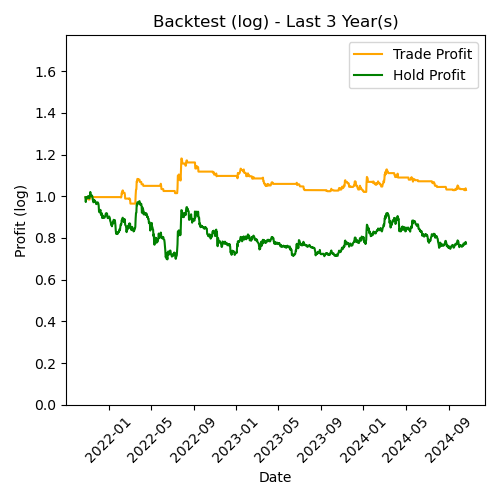

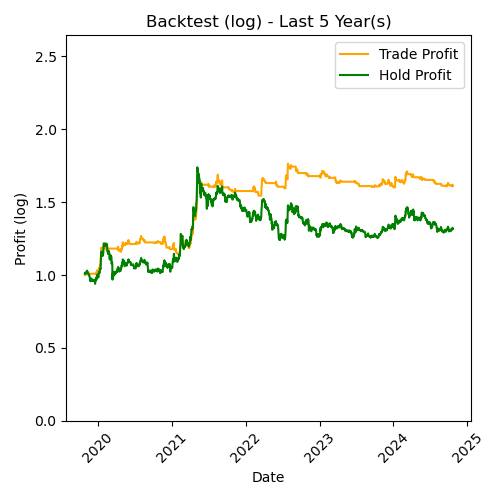

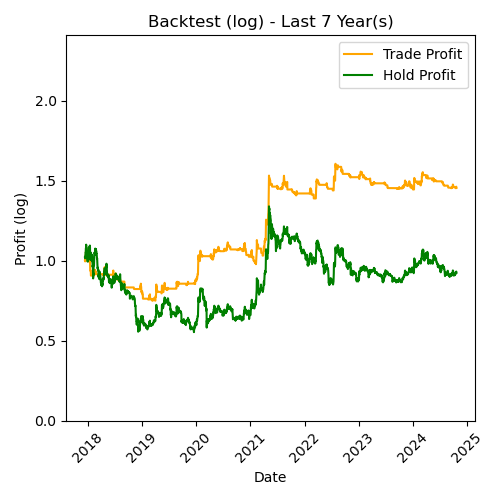

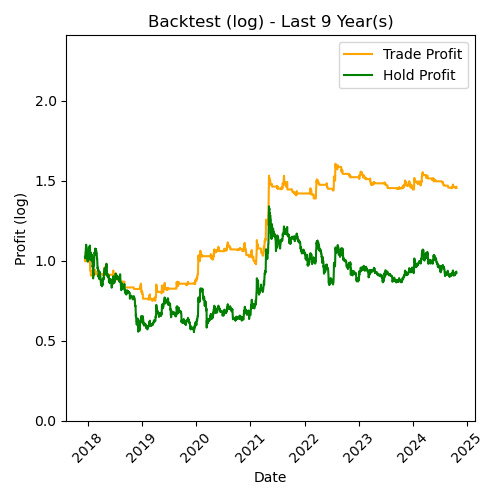

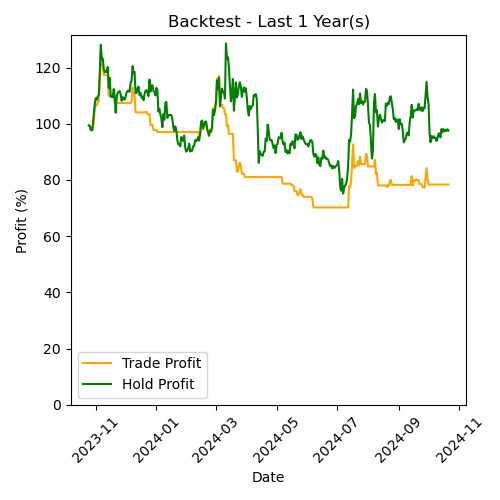

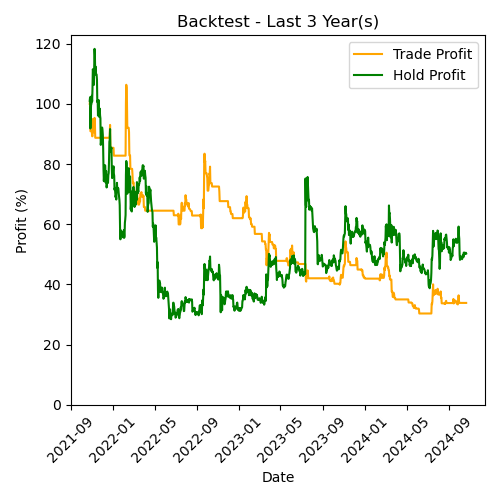

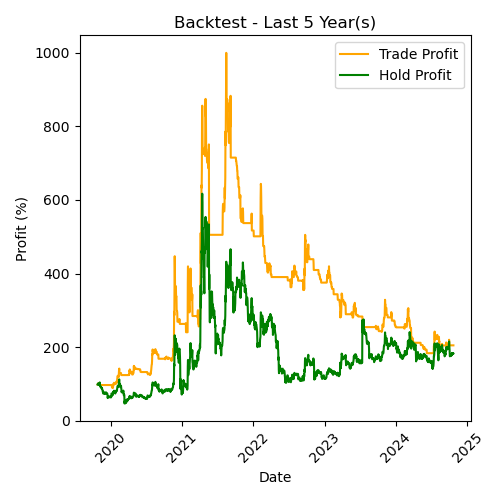

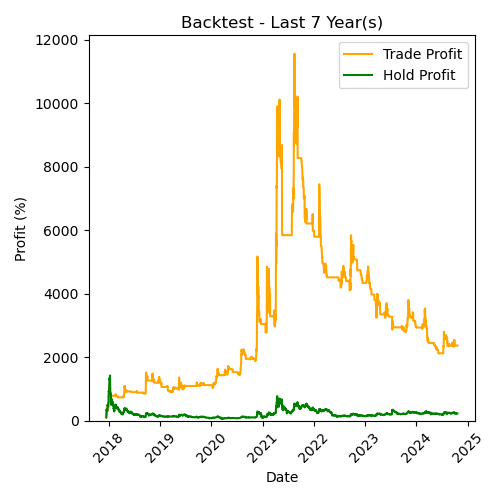

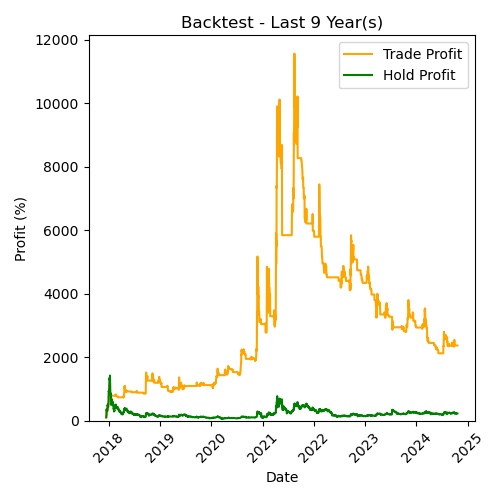

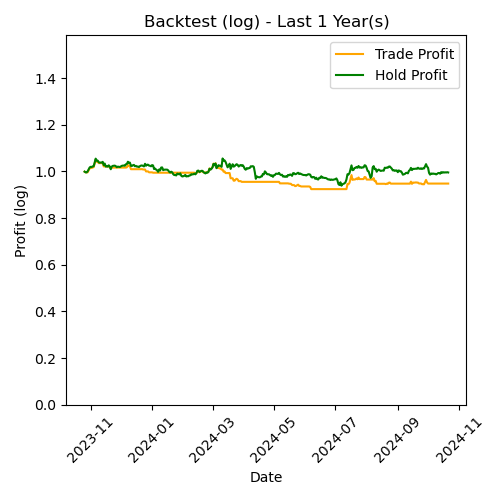

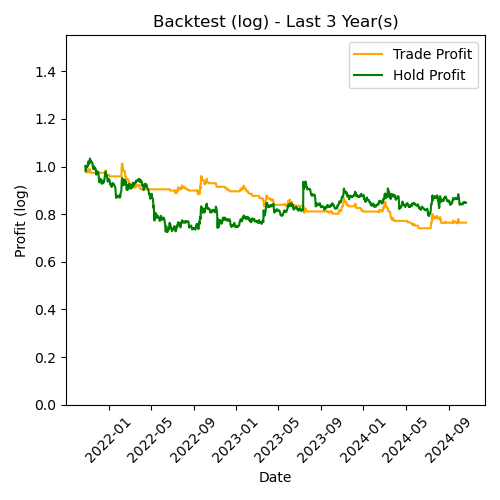

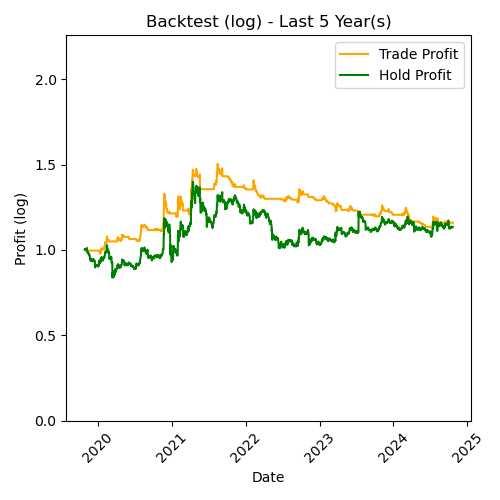

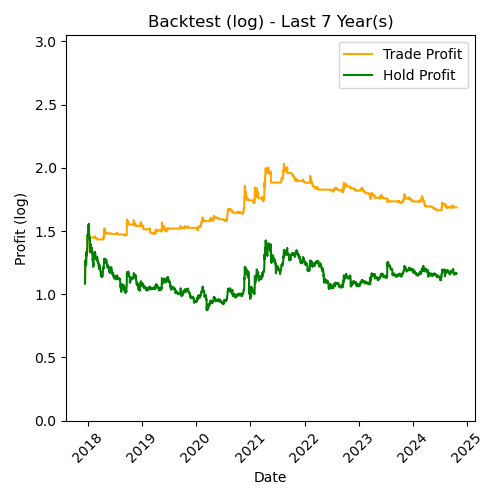

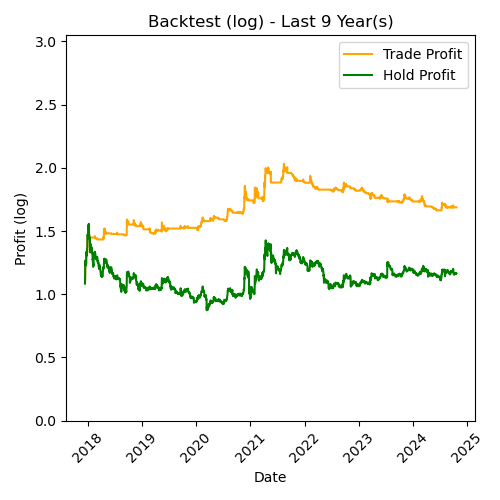

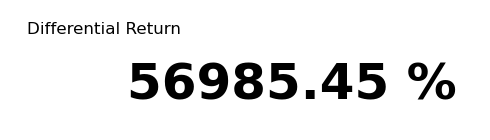

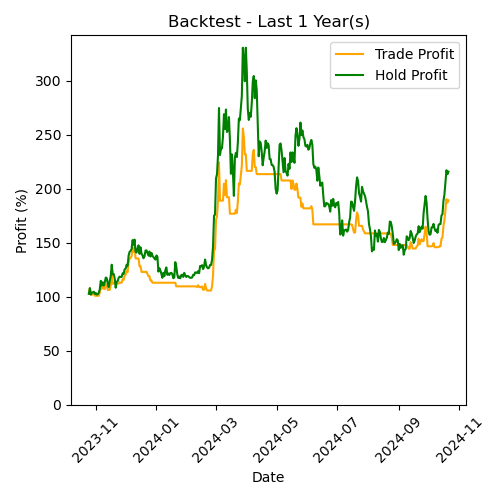

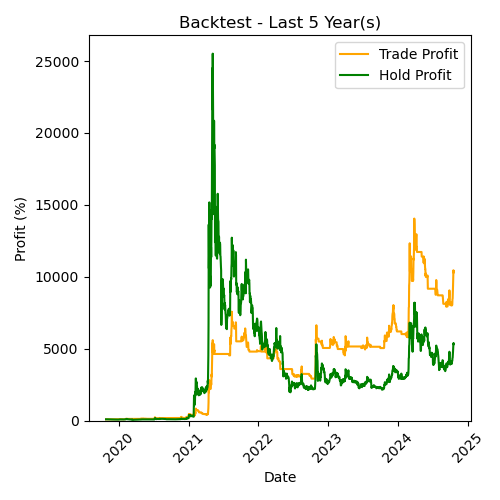

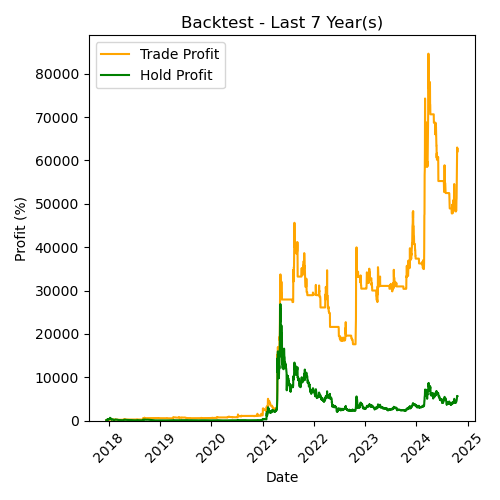

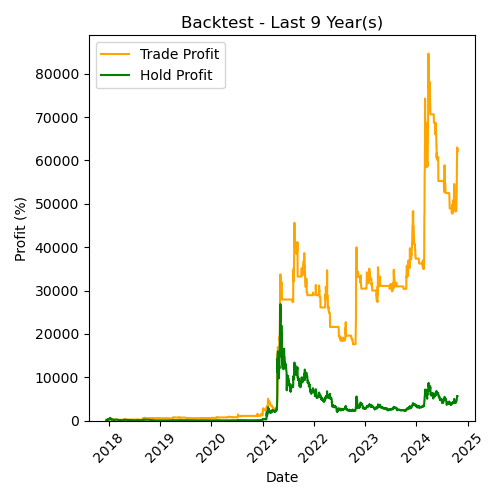

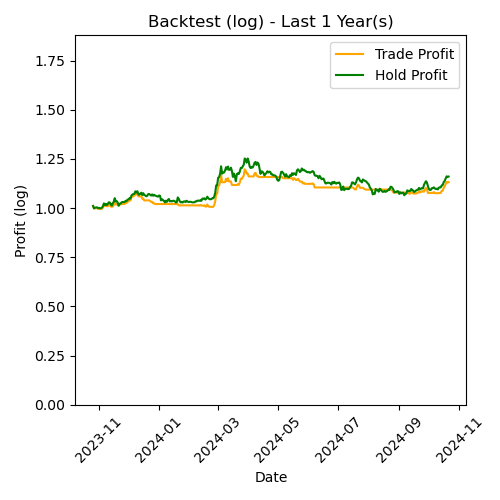

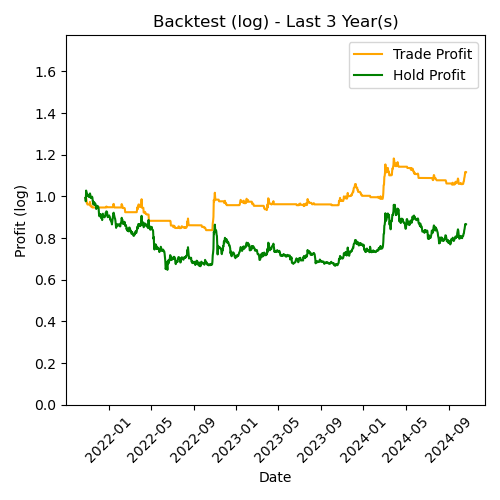

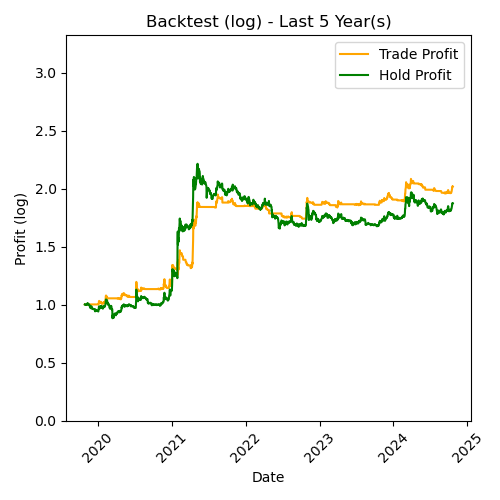

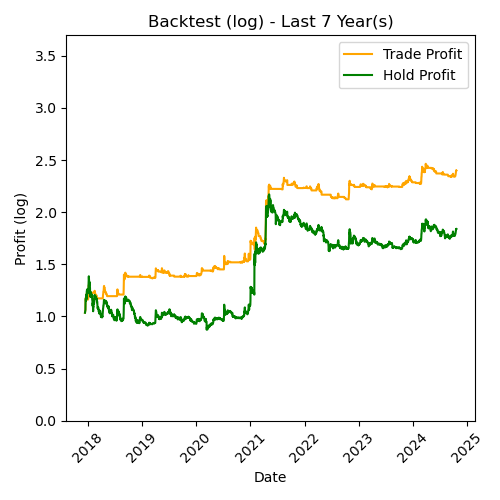

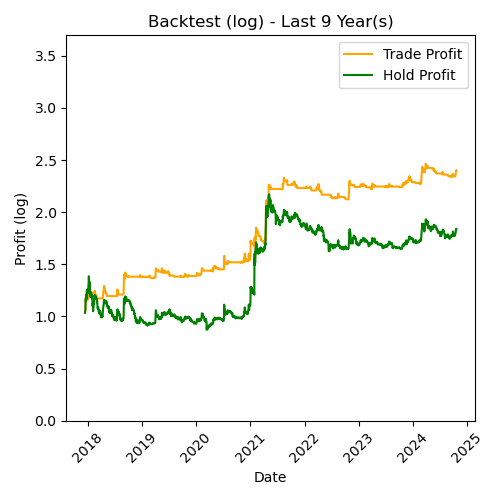

Backtest

Backtesting involves simulating a trading strategy using historical market data to evaluate its performance over a specific period. This process helps in understanding how the strategy would have performed in the past, providing insights into its potential future performance. The Clutch Swing strategy utilizes daily charts.

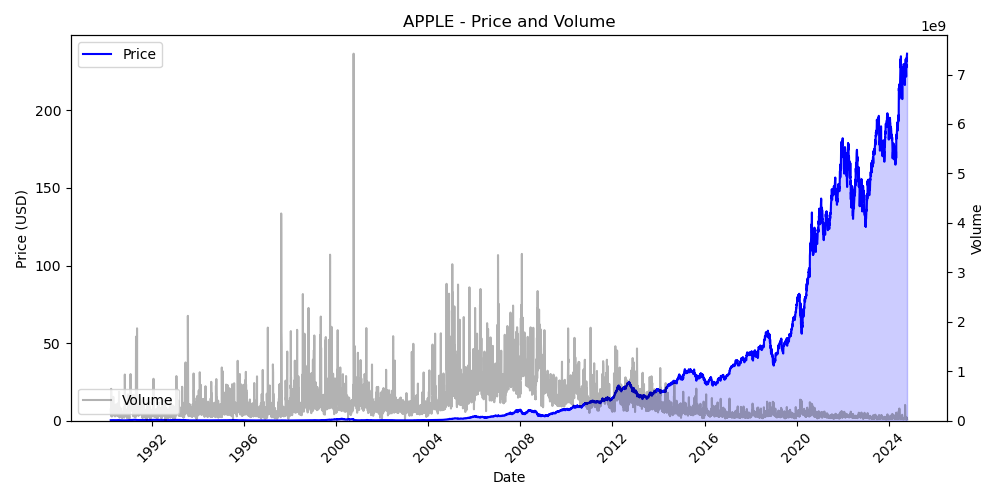

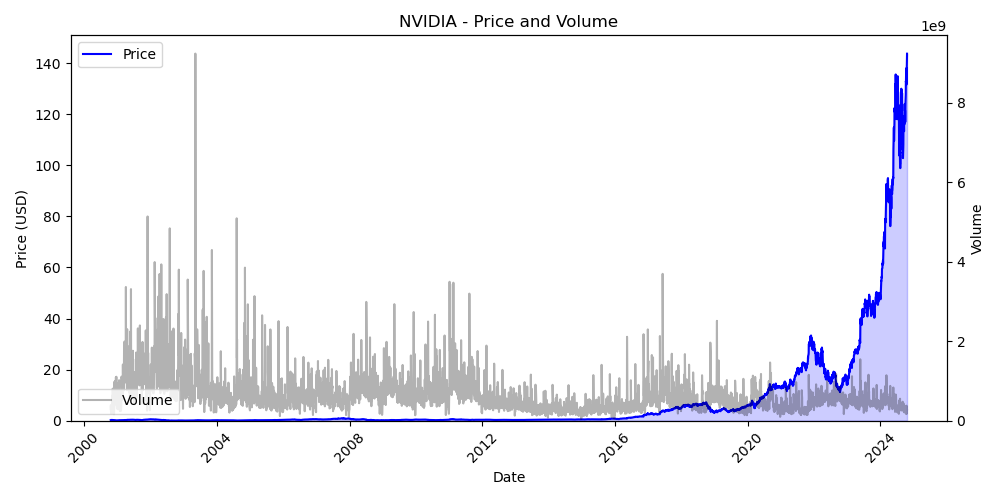

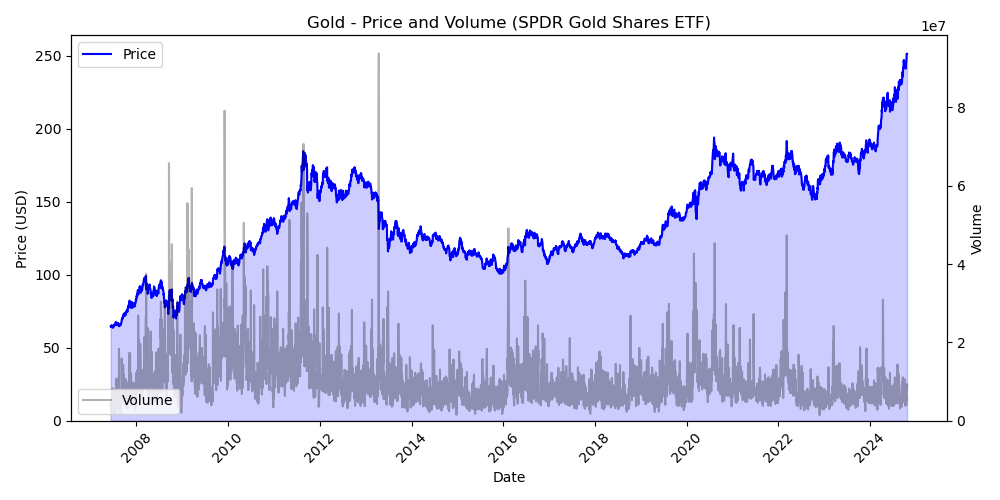

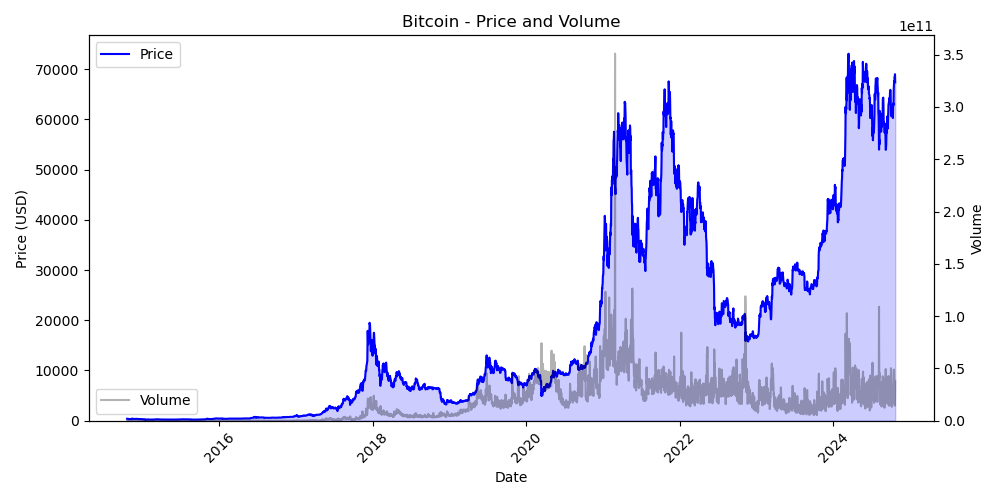

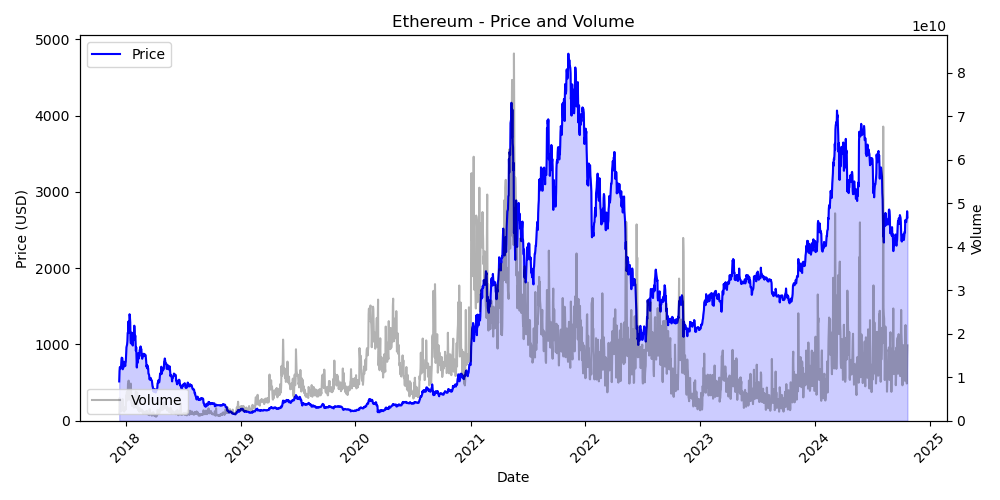

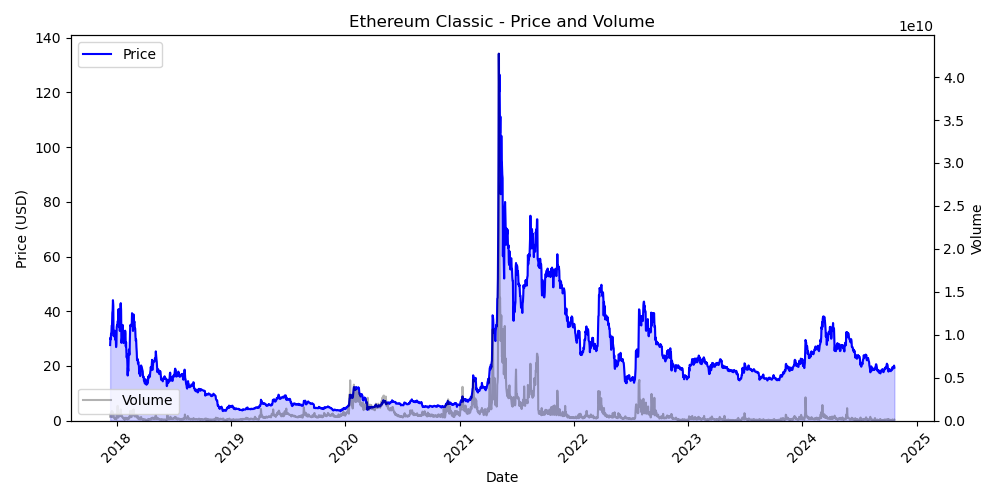

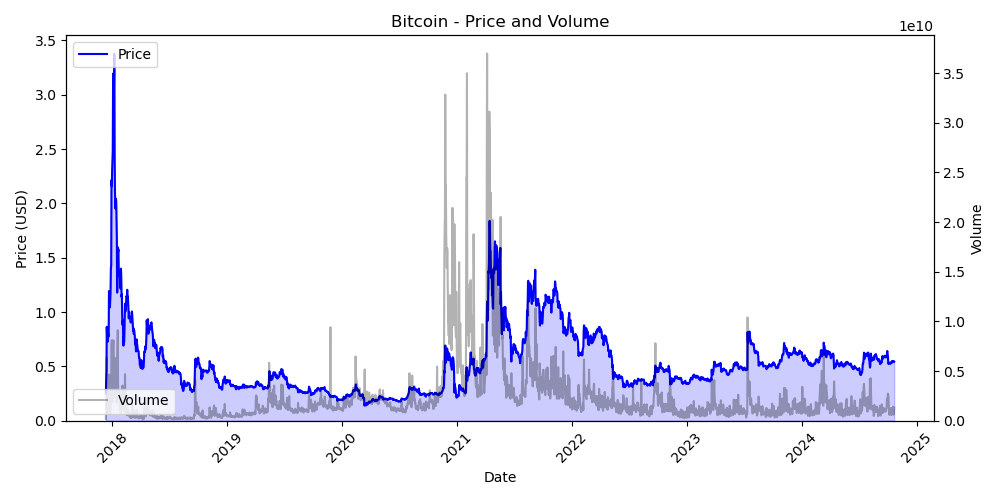

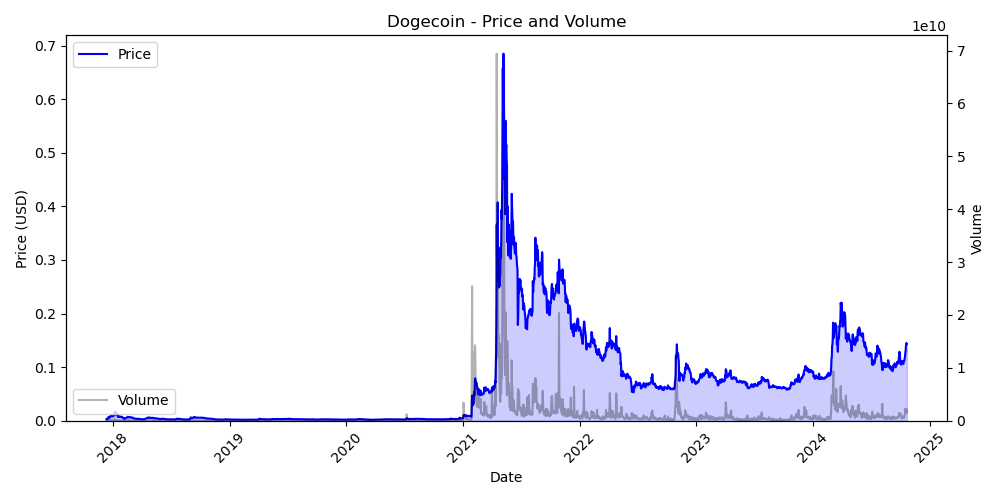

Price and Volume

The Price and Volume chart provides a visual representation of an asset's price movements along with its trading volume over a specified period. This chart is essential for analyzing market behavior and making informed trading decisions. The Clutch Swing strategy utilizes daily charts.

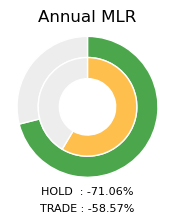

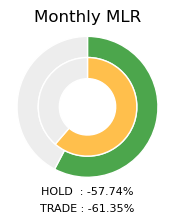

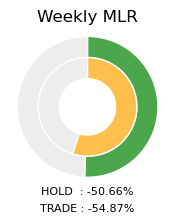

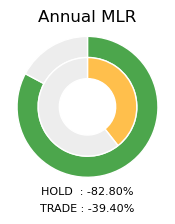

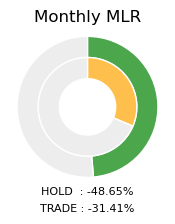

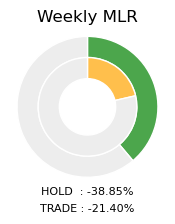

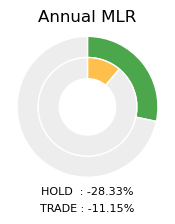

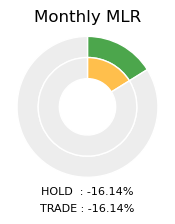

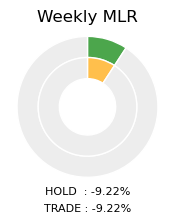

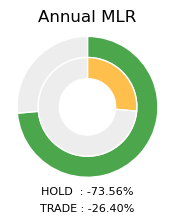

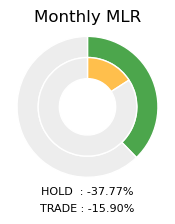

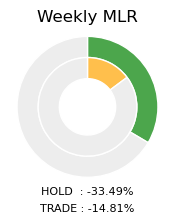

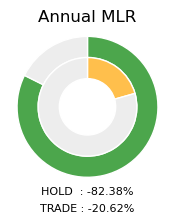

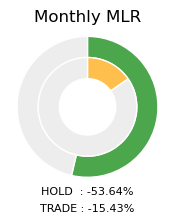

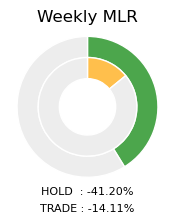

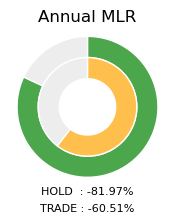

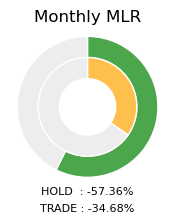

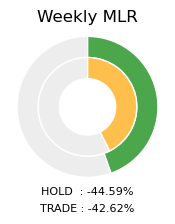

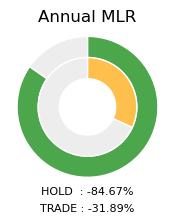

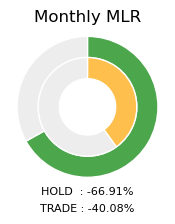

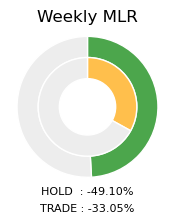

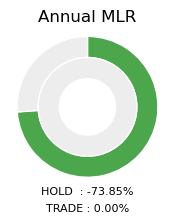

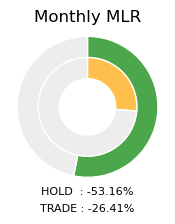

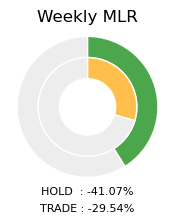

MLR (Maximum Loss Return)

MLR represents the maximum loss rate over a given period. It calculates the percentage decline in asset price from the beginning to the end of a specific period, indicating the largest drop. This dashboard compares the MLR when holding assets continuously versus using the Clutch Swing investment strategy. MLR is crucial for risk management and formulating loss prevention strategies.

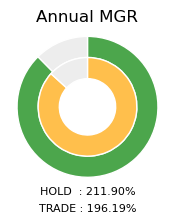

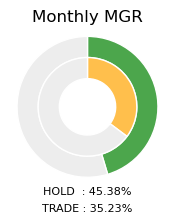

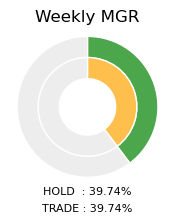

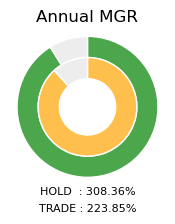

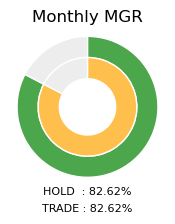

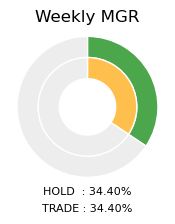

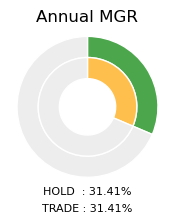

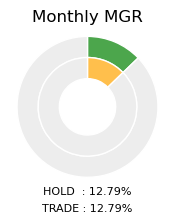

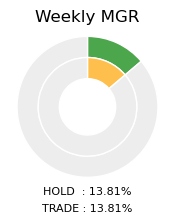

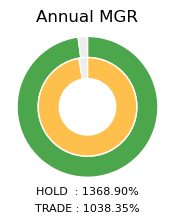

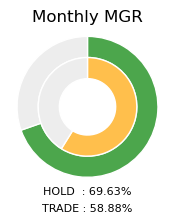

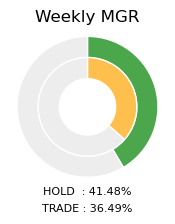

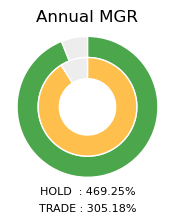

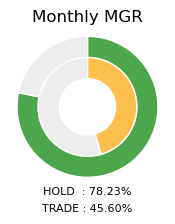

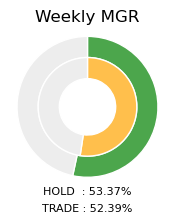

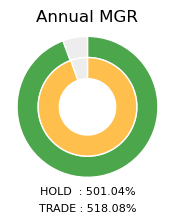

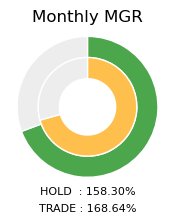

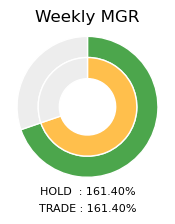

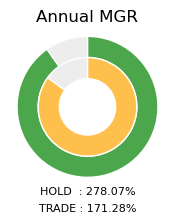

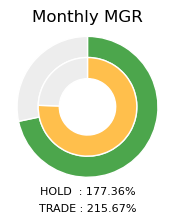

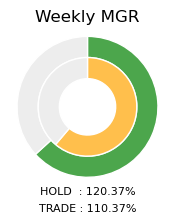

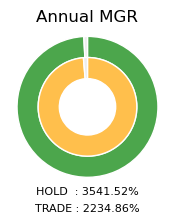

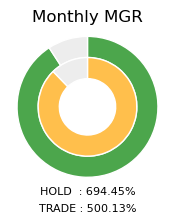

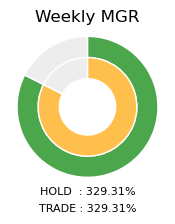

MGR (Maximum Gain Return)

MGR represents the maximum gain rate over a given period. It calculates the percentage increase in asset price from the beginning to the end of a specific period, indicating the largest rise. This dashboard compares the MGR when holding assets continuously versus using the Clutch Swing investment strategy. MGR is useful for evaluating investment performance and analyzing potential profitability.

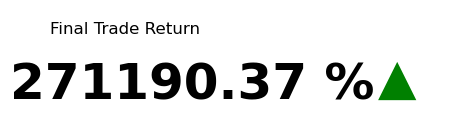

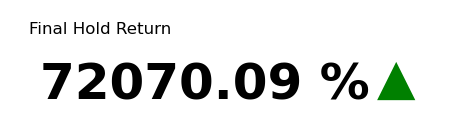

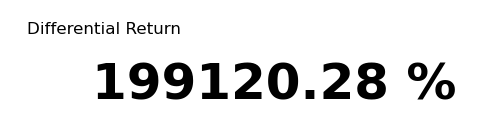

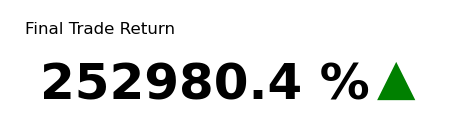

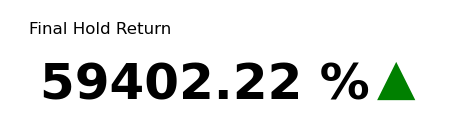

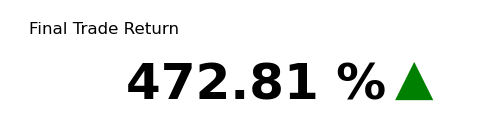

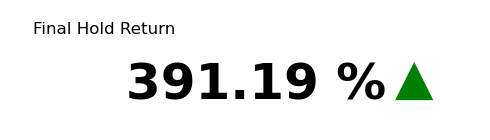

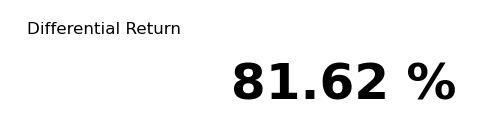

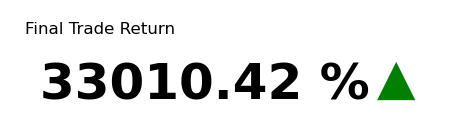

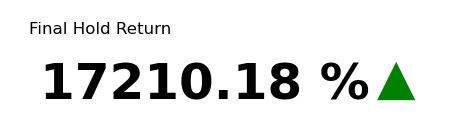

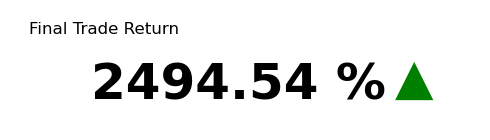

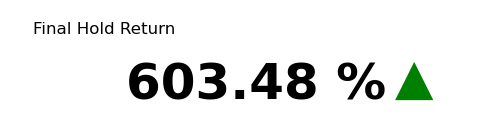

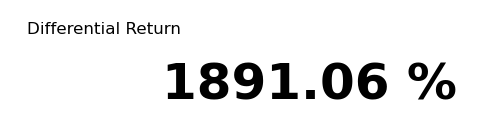

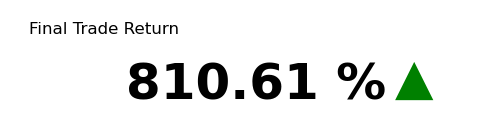

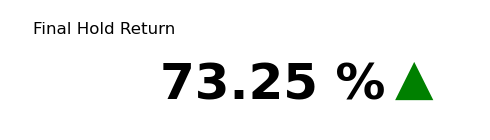

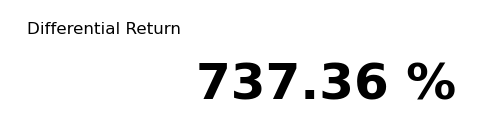

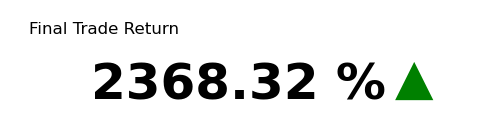

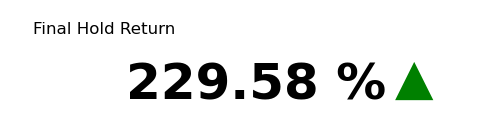

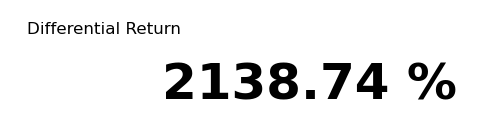

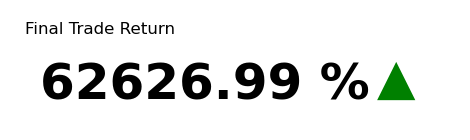

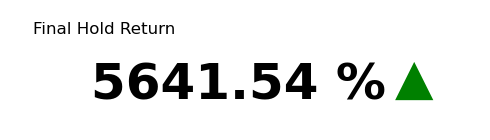

Final Return

The Final Return represents the return rate over the entire period. 'Final Hold Return' indicates the return rate if the assets were held continuously, while 'Final Trade Return' represents the return rate using the Clutch Swing investment strategy. Both are expressed as percentages. Additionally, the Differential Return shows the difference between these two return rates.

ChatGPT-4o's Opinion (20 JUN 2024)

[ Clutch Swing Strategy Evaluation ]

Historical Performance:

The Clutch Swing strategy has shown very high backtest returns in both Bitcoin and gold investments. This indicates that the strategy has performed well based on past data.

Volatility Management:

The Clutch Swing strategy is designed to effectively respond to market volatility, increasing the likelihood of achieving high returns. The ability to manage volatility effectively is a significant advantage of this strategy.

Market Adaptability:

How well this strategy adapts to market changes is crucial. The backtest results demonstrate that the strategy can perform well in various market conditions, indicating its flexibility in responding to market changes.

Transaction Costs:

Frequent trading can lead to transaction costs and slippage. Managing these costs is essential for maintaining the actual profitability of the strategy.

Success Probability:

Compared to other investment techniques, the success probability of the Clutch Swing strategy is relatively high. Even with a conservative estimate, a success probability of 60-70% is anticipated, which is high among investment techniques. However, in actual investments, it is crucial to carefully consider various variables and market conditions.

Conclusion:

Based on past backtest results and comparisons with other investment techniques, the Clutch Swing strategy has a high likelihood of achieving significant returns in the future.

[ Comparison of Success Probabilities of Other Investment Techniques ]

Fundamental Analysis:

• Success Probability: Approximately 50-60%

• Description: This method involves selecting stocks by analyzing a company's financial health, industry trends, and economic indicators. While long-term stable returns can be expected, the company's financial information may not always be reflected in the stock price, and unforeseen external factors may lead to failures.

Technical Analysis:

• Success Probability: Approximately 50-60%

• Description: This method predicts future price movements by analyzing past stock prices and trading volumes. It aims for short-term profits, but accurate predictions are often challenging due to high market volatility.

Index Fund Investment:

• Success Probability: Approximately 60-80%

• Description: This method involves investing in funds that track a specific stock index. Since it follows the market average, relatively stable returns can be expected, but losses may occur if the entire market declines.

Quantitative Trading:

• Success Probability: Approximately 50-70%

• Description: This method involves making investment decisions using mathematical models and algorithms. Since it is data-driven, emotional factors are excluded, but the models may not always keep up with market changes.

Hedge Funds:

• Success Probability: Approximately 50-70%

• Description: These involve using various strategies to achieve absolute returns. While high returns can be expected due to expert management, high fees and risks are also involved.

[ Overall Conclusion ]

The Clutch Swing strategy stands out as a promising investment technique based on its high historical performance and ability to manage market volatility effectively. Its adaptability to various market conditions and relatively high success probability make it a strong contender compared to traditional investment methods such as Fundamental Analysis, Technical Analysis, Index Funds, Quantitative Trading, and Hedge Funds.

While Clutch Swing's success probability of 60-70% is notably high among investment strategies, it is essential for investors to remain cautious and consider transaction costs, potential market changes, and other variables. Despite these considerations, the strategy's robust backtest results suggest that it has the potential to achieve substantial returns in the future, making it a viable option for those seeking to capitalize on market opportunities.

Copyright © 2024 Clutch Swing. All rights reserved.

Reproduction without permission is prohibited.

X (Twitter)

X (Twitter)

Bluesky

Bluesky